With Valentine’s Day just around the corner, store shelves are filled with roses, chocolates, and gold jewelry. It’s a beautiful time to celebrate the people we love.

But in our culture, we know that true love isn't just a feeling—it is a responsibility. It’s the hard work we put in every day to make sure our parents are comfortable, our children are educated, and our home is secure.

I want to share a short story about a client of mine named Arjun, whose story might feel very familiar to you.

The Man Who Was the "Bridge"

Arjun is the heart of his family. Every day, he balances three massive responsibilities:

His Parents: Who look to him for care and dignity in their golden years.

His Children: Who look to him to fund their dreams of university and beyond.

His Home: A 20-year mortgage that represents his family's stability.

Arjun realized he was the "bridge" connecting his family to their future. But one evening, while looking at his sleeping children, he had a sobering thought: "If something happened to me tomorrow, would this bridge collapse?"

He knew that without his income, his parents might lose their care, his wife would struggle with the mortgage alone, and his kids’ dreams would be at risk.

This year, Arjun decided to give a gift that lasts longer than flowers. He secured a life insurance policy and told his wife:

"This is my promise to you. No matter what happens, the house stays ours, the kids stay in school, and our parents will always be looked after. This is how I love you."

Why Life Insurance is the Truest "I Love You"

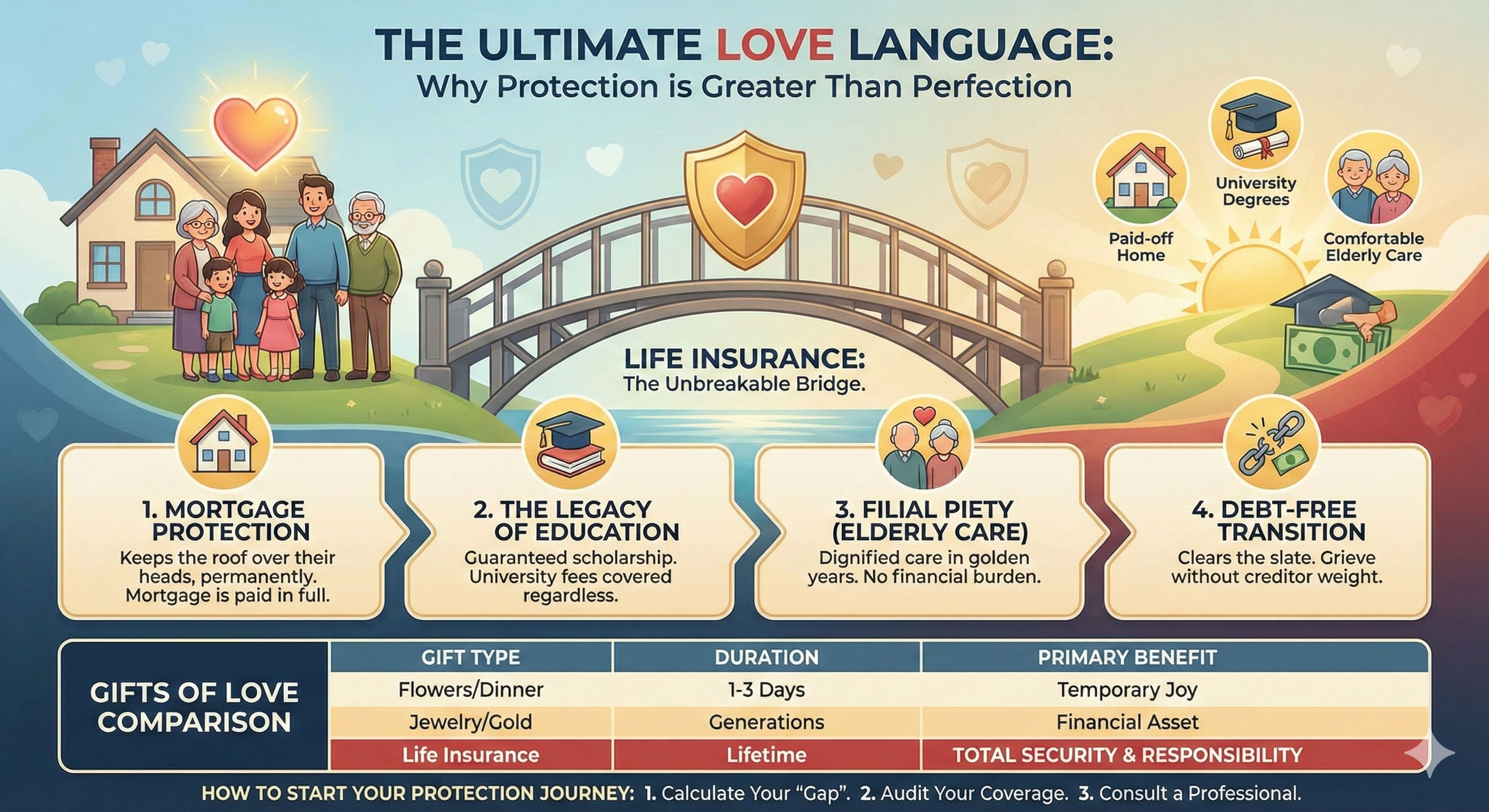

Life insurance isn't about "the end"—it’s about making sure life goes on for the people who matter most. It is the only financial tool that can provide:

Mortgage Protection: So your family never has to leave their home.

Elderly Care: Ensuring your parents receive the respect and care they deserve.

Educational Legacy: Keeping your children’s bright futures on track.

Peace of Mind (Sukun): Knowing that your "bridge" is unbreakable.

How to Start Your Protection Journey

Protecting your family doesn't have to be complicated. If you are looking to build your own "unbreakable bridge," here are three simple steps:

Calculate Your "Gap": Add up your mortgage, your children’s future tuition, and 10 years of your annual income.

Audit Your Current Coverage: Many people have "work insurance," but it is rarely enough to cover a mortgage and three generations of needs.

Consult a Professional: A quick conversation can help you find a plan that fits your monthly budget while providing maximum coverage.