As we head into 2026, many of us are looking for ways to keep more of our hard-earned money and plan for a comfortable future. One of the most powerful tools in your financial toolkit is the RRSP (Registered Retirement Savings Plan).

Whether you want to lower your tax bill this year or are dreaming of buying your first home, here is everything you need to know in plain English.

1. How RRSPs Help You Save & Build Wealth

Think of an RRSP as a "tax-sheltered" bucket for your savings. It helps you in two major ways:

- Instant Tax Savings: When you put money into an RRSP, the government considers that money "untaxed." For example, if you earn $70,000 and contribute $5,000 to your RRSP, you only pay taxes as if you earned $65,000. This often results in a nice tax refund check in the spring!

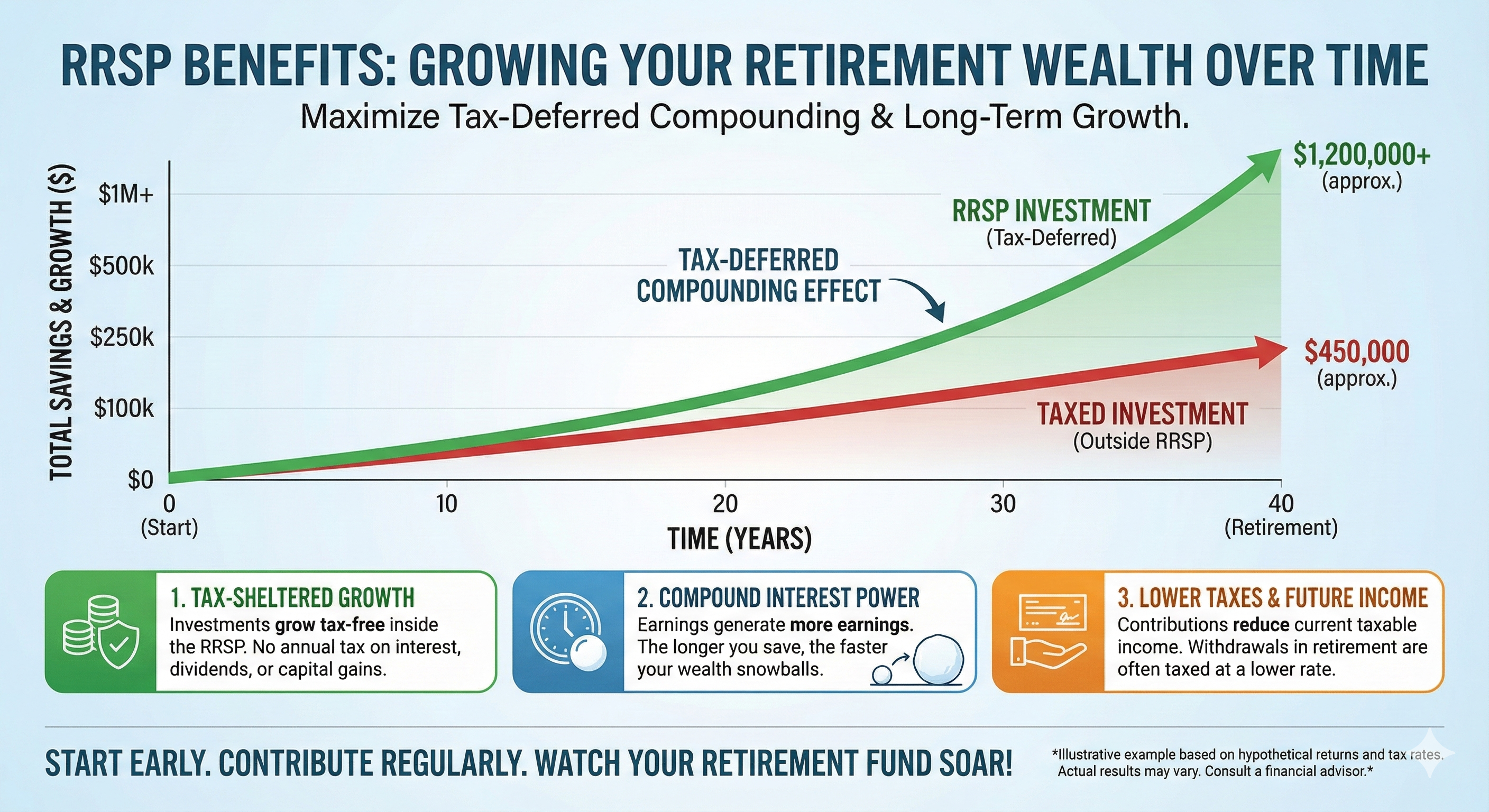

- Tax-Free Growth: Inside the account, your money can be invested in stocks, bonds, or GICs. You don’t pay a penny of tax on the interest or growth while the money stays in the account. This allows your wealth to "snowball" much faster over decades.

2026 Limit: You can contribute up to 18% of your previous year’s income, to a maximum of $33,810 for the 2026 tax year.

2. Buying Your First Home? Use the HBP

The Home Buyers’ Plan (HBP) is a special rule that lets you "borrow" from your own retirement savings to buy your first home without paying taxes on the withdrawal.

- The Limit: You can withdraw up to $60,000 (or $120,000 for a couple) tax-free.

- The Benefit: It’s essentially an interest-free loan from yourself to help with a down payment.

- The Rule: You must have the money in your RRSP for at least 90 days before you withdraw it.

Repayment: You have 15 years to pay the money back into your RRSP. Repayments usually start the second year after you withdraw the funds.

3. Is an RRSP Always the Best Choice?

While RRSPs are great, they aren't for everyone. Since you have to pay tax when you eventually take the money out in retirement, the strategy only works best if you are in a high tax bracket now and expect to be in a lower one later.

Comparison: To RRSP or Not?

4. The "Catch": Disadvantages to Watch Out For

- Taxes on Withdrawal: When you retire and take money out, that money is taxed as regular income. If you have a massive RRSP, you might end up in a high tax bracket even in retirement!

- Loss of Contribution Room: Unlike a TFSA, if you take money out for an emergency (and it's not for a home or education), you lose that contribution space forever.

OAS Clawbacks: If your retirement income is too high because of large RRSP withdrawals, the government might reduce your Old Age Security (OAS) benefits.